Presentation

Current financial transactions are carried out via a variety of electronic channels. However, traditional approaches, including taking a look at, continue to play a significant role in the monetary system. A system known as Attractive Ink Character Acknowledgment (MICR) is used to ensure the efficient handling and confirmation of checks. This page aims to provide a thorough understanding of MICR code, its significance, and its use in the financial sector.

An MICR code is what?

The term “MICR code” refers to the unusual numerical code placed on the bottom of cheques and other disputed items. It is a vital component of the cheque handling system used by financial institutions like banks. Data required for organising, directing, and verifying actual examinations is contained in the code.

MICR Code’s Importance

The MICR code plays a crucial role in ensuring the efficiency and security of actual cheque handling. It takes into consideration computerised cheque organising and reading, reducing human error and handling time. Furthermore, the code permits check confirmation, making it difficult for counterfeit checks to pass through the system unnoticed.

Making of the MICR Code

The MICR code is made up of a nine-digit number divided into the bank code, branch code, and actual look code. Each component meets a specific purpose in identifying the bank, office, and record associated with the cheque. The code can be read by MICR readers because it is printed with a special kind of ink that contains appealing particles.

What is the Use of MICR Code?

When a cheque is saved or presented for payment, it passes through a mechanically assisted review handling system. Rapid MICR perusers scan the MICR code and extract the relevant information from it. Using this information, the checks are organised, sent to the appropriate bank and branch, and verified as genuine.

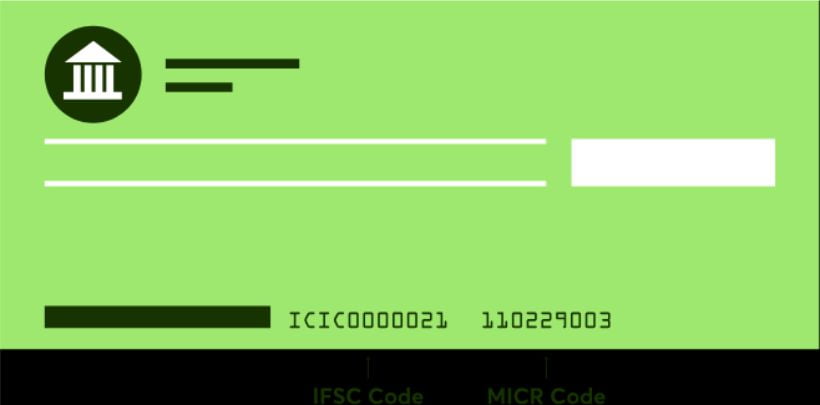

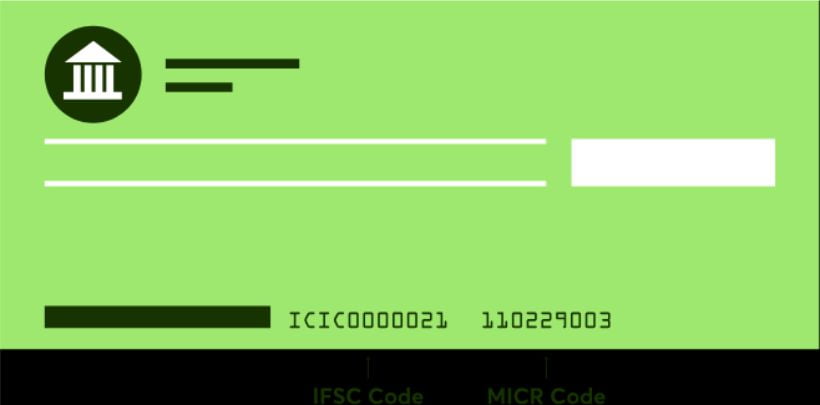

Comparison of the MICR and IFSC codes

Although the Indian Monetary Framework Code (IFSC) and the MICR code are both used in banking, they serve different purposes. While the IFSC code is used for electronic asset transfers and online exchanges, the MICR code is mostly used for physical cheque handling. The IFSC code is required for online transactions like NEFT, RTGS, and Pixies, while the MICR code is embossed on checks.

Getting a MICR code

A reference to the lower portion of a genuinely look at given by a bank will yield the MICR code. The MICR code is typically printed with a unique writing style that makes it easily recognisable. The bank’s website, passbooks, and explanations all have access to it as well.

Security Aspects of the MICR Code

MICR codes are planned with a few security highlights to forestall altering and forging. The utilization of attractive ink guarantees that any modification endeavors are effectively discernible. In addition, the printing of the MICR code requires particular gear and ink, making it moving for fraudsters to imitate.

Advantages of MICR codes

There are certain financial advantages to using MICR codes. These include shorter handling times, more accuracy when working with limited resources, fewer manual errors, and improved protection against bogus checks. Additionally, the MICR code’s normalised setup ensures uniform real-world look at handling throughout the financial system and facilitates interoperability between numerous banks.

Limitations of the MICR Code

The MICR code has limitations even though it is widely used and powerful. The structure is heavily reliant on the printed code’s characteristics and how well MICR readers read it. Any tampering with the code or damage to it could result in handling errors. Furthermore, the framework might not be appropriate for other types of installment or archive verification since it is primarily designed for printed checks.

Banking with MICR Code

For genuine look-at handling, account ID, and archive validation, the financial industry relies heavily on MICR codes. Banks employ MICR innovation to simplify business processes, increase their effectiveness, and enhance customer service. Banks are able to precisely and securely manage a large volume of checks thanks to the code.

The handling of MICR codes in line

MICR codes are essential for identifying the bank, office, and record associated with each cheque in the cheque handling system. The codes are read by quick MICR readers, who then sort the checks according to their purpose and route them as necessary. Compared to manual organising, this robotized interaction saves time and resources.

In the Report Confirmation, the MICR Code

MICR codes are used for more than only handling and play a role in document verification. For instance, they are used to examine authoritative reports, character cards, and other sensitive papers. Significant archives are more secure and reliable because of the MICR code’s unique design and ink, which makes it difficult to forge.

Digital Installer Frameworks with MICR Code

Electronic clearing services and direct charge procedures are two examples of computerised payment systems that use the MICR code. It properly identifies the starting and getting banks, enabling the continuous transfer of assets between accounts. Due to this, computerised transactions are safe and effective.

Result of MICR Code

The use of physical checks may eventually become less common due to the ongoing advancements in advanced payment systems. However, the MICR code innovation will continue to be used in the near future. Its use in record verification and other fields outside of cheque processing ensures that it will continue to be important in the financial sector.

End

A fundamental component of the real-time handling infrastructure, the MICR code plays a significant role in the financial industry. A constructive look at organising, directing, and validation is made possible by the ink’s lovely presentation and exceptional organisation. Numerous benefits of the MICR code include easier handling, increased accuracy, and increased security. The MICR code continues to be a crucial component of the financial system, ensuring seamless and secure transactions even in the face of its limitations.

FAQs

Q1. Could online transactions use the MICR at any point code?

No, the MICR code is not required for online transactions; instead, it is primarily used for cheque handling. The Indian Monetary Framework Code (IFSC) is used for online exchanges.

Q2. Is the MICR code fairly consistent throughout the entire bank?

No, every component of a bank has a unique MICR code. The exact branch and record associated with a cheque are identified by the MICR code.

Q3. Can the MICR code be modified or updated at any time?

The MICR code is designed with security features that make changes easily discernible. Since the MICR code requires certain ink and equipment to print correctly, any attempt to modify or alter it would be easily detectable.

Q4. Where can I discover my ledger’s MICR code?

The MICR code is printed on your checkbook’s lower portion as well as the lower portion of your real checks. Along with your passbook and explanations, it is also available on your bank’s website.

Q5. Is India the only country that uses the MICR code?

A few countries, including India, have adopted the MICR code structure, which was initially developed in the US. In India, it is widely used for banking and examination processing activities.

Q6. What occurs if the MICR code on a cheque is incorrectly read?

Inability to read or damage to the MICR code on a cheque may result in processing errors or deferrals. In certain situations, it may be necessary for the cheque to be handled physically or confirmed by the bank, both of which can add delay.

Q7. Could the MICR at any point code be utilized to follow a really look at’s installment status?

A check’s installment status cannot be determined by the MICR code alone. You would need to speak with your bank or use the web-based financial services offered by your banking institution to monitor the situation with a cheque.

Q8. Is MICR offering any optional enhancements for handling that genuinely look at it?

Despite the increasing popularity of electronic installation methods, MICR technology continues to remain the industry standard for genuine look-at handling. To improve accuracy and efficacy in relation to MICR, various innovations, such as OCR (Optical Person Acknowledgment), are used.

Q9. Does the record number have a connection to the MICR code?

The record number and the MICR code are related but serve different purposes. The bank and branch associated with the record are identified by the MICR code, whereas the record number, in an intriguing distinction, identifies the actual record.

Q10. Could phoney checks be detected using the MICR at any point code?

In fact, spotting phoney checks depends heavily on the MICR code. Forgers find it challenging to accurately replicate the MICR code due to the unique appealing ink used in the system. In light of the MICR code, banks and financial institutions use quick MICR readers to verify the authenticity of checks.

Overall, the MICR code is a crucial component of the actual cheque handling framework and provides essential information for precise cheque arranging, steering, and validation. Its use in the banking sector ensures efficient and secure transactions. While the computerised installation scene is still evolving, MICR code technology is nevertheless useful in archive validation and other fields outside of real look at handling. Our understanding of the monetary system and its basic cycles is enhanced by knowing what the MICR code means.

Do you Know about IFSC Code ?